The Disabled Access Tax Credit

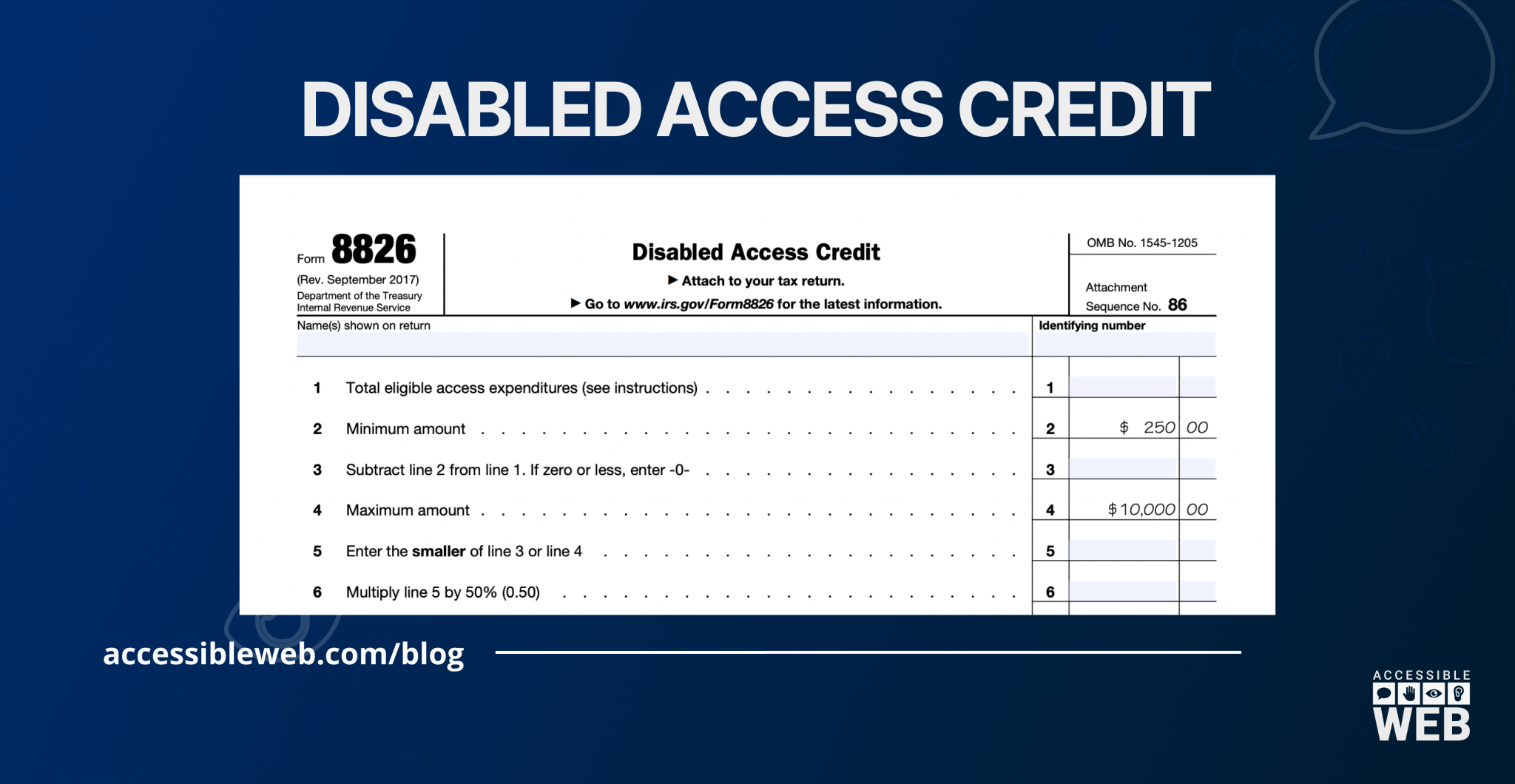

Complying with the Americans with Disabilities Act may require a financial investment on your part. However, small business owners may claim a tax credit for this commitment. The Disabled Access Tax Credit, IRS form 8826, is part of the general business credit and provides a tax credit of up to $5,000 to small business owners with accessibility expenses. The qualifications are below.

Small business eligibility:

- Had gross receipts for the preceding tax year that did not exceed $1 million OR had no more than 30 full-time employees* during the preceding tax year AND

- Elects (by filing Form 8826) to claim the disabled access credit for the tax year

*Full-time employees = employees working at least 30 hours a week for more than 20 weeks during the year.

Eligible access expenditures include expenses:

- To remove barriers that prevent a business from being accessible to or usable by individuals with disabilities;

- To provide qualified interpreters or other methods of making audio materials available to hearing-impaired individuals;

- To provide qualified readers, taped texts, and other methods of making visual materials available to individuals with visual impairments;

- To acquire or modify equipment or devices for individuals with disabilities.

Your accessibility expenses are capped at $10,000. The calculation is as follows:

Total Cost of Accessibility/2.

In other words, divide the total cost of accessibility expenses (up to $10,000) by 2 to determine your credit. There is a credit maximum of $5,000 for a business.

Our team of certified accessibility professionals at Accessible Web is ready to help you meet your goals. Take advantage of this credit to invest in your web accessibility journey and ensure that 26% of Americans aren’t losing access to your products and services.

This document is not intended to provide legal tax advice. Please consult the IRS or a tax professional.

Sources:

About Form 8826, Disabled Access Credit